Synergy: AI Drives Q423 Cloud Computing Spending Reaches New Point

According to new data from Synergy Research Group, global enterprises spent nearly $74 billion on cloud infrastructure services in the fourth quarter of 2023, an increase of over $12 billion compared to the fourth quarter of 2022. The year-on-year growth rate in the fourth quarter of 2023 was 20%, significantly higher than the previous three quarters. It is worth noting that the market grew by $5.6 billion compared to the third quarter of 2023, which is the largest quarter on quarter growth achieved so far. From a full year perspective, the market has grown by 19% compared to 2022. Although the economic, monetary, and political headwinds have weakened, it is clear that generative artificial intelligence technology and services have had a significant impact, helping to further drive cloud spending.

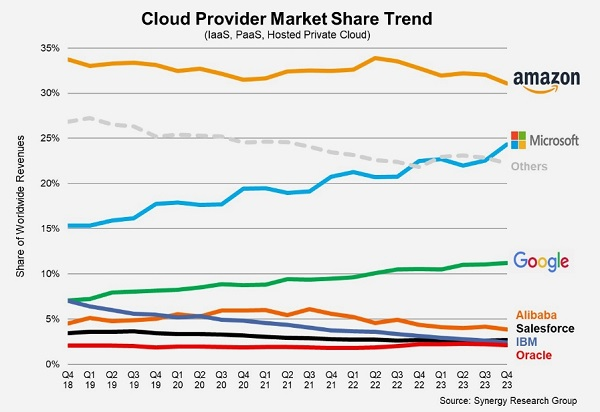

In terms of competitive landscape, among the largest cloud service providers, Google and Microsoft have stronger year-on-year growth data. Microsoft’s global market share has increased by nearly two percentage points compared to the fourth quarter of 2022, and Google’s share has also increased. Their global market share in the fourth quarter of 2023 was 24% and 11%, respectively. Meanwhile, market leader Amazon’s global market share has declined to 31%, despite maintaining strong double-digit growth. These three giants together account for 67% of the global market share. Among secondary cloud service providers, Huawei, China Telecom, Snowflake, MongoDB, Oracle, and VMware have the highest year-on-year growth rates.

Currently, most major cloud service providers have released their Q4 2023 financial reports. Synergy estimates that the quarterly revenue for global cloud infrastructure services (including IaaS, PaaS, and hosted private cloud services) in the fourth quarter of 2023 will be $73.7 billion, and the full year revenue for 2023 will reach $270 billion. Public IaaS and PaaS services accounted for the majority of the market, growing by 21% in the fourth quarter.

The dominant position of major cloud service providers is more evident in the public cloud sector, with the top three accounting for 73% of the market share. Geographically, the cloud market in all regions of the world continues to grow strongly. In local currency terms, the Asia Pacific region has the strongest growth, with annual growth rates of over 20% in India, China, Australia, and Japan. The United States remains the largest cloud market to date, with a scale larger than the entire Asia Pacific region. The US market grew by 16% in the fourth quarter.

Due to the improvement of the market environment and the wave of generative artificial intelligence, the actual growth rate in the fourth quarter of 2023 was higher than Synergy’s expectations. Cloud computing is now a huge market that requires a lot of momentum to drive, but artificial intelligence has already achieved this. Looking ahead, the law of large numbers means that the cloud market will never recover to the growth rate before 2022, but Synergy does predict that the growth rate will now stabilize, driving significant and sustained annual growth in cloud spending. Synergy predicts that the annual market size of global cloud spending will soon reach $500 billion.