Growth Rate of Broadband Users in US Slowed down Comprehensively in First Quarter of 2024

The growth rate of broadband users in the United States significantly slowed down in the first quarter of 2024, with fiber optic, fixed wireless access (FWA), and wired broadband service providers performing worse than the same period last year.

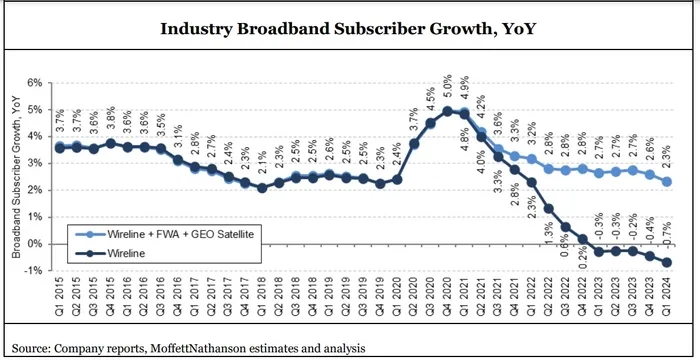

In the first quarter of 2024, the net growth of the industry, including or excluding FWA and Geosynchronous (GEO) satellite broadband providers, significantly slowed down. Moffett Nathanson estimates in his latest broadband industry trend report that the overall market’s year-on-year growth rate has dropped to 2.3%, the lowest level since the COVID-19 pandemic. If the FWA and GEO satellite categories are not included, the growth rate is much worse, at -0.7%.

Moffett Nathanson analyst Craig Moffett explained that in terms of user units, the overall net growth of the US broadband market decreased by 299000 compared to the same period last year, which is “the sharpest since the second quarter of 2022.”.

Moffett believes that part of the reason for this trend is slow housing construction. According to data from the Census Bureau, the number of homes in the United States decreased by approximately 311000 in the first quarter of 2024. This analyst acknowledges that census data has been unreliable in history, but he still believes that housing formation is undoubtedly slowing down this quarter.

The entire broadband market has also reached saturation this quarter. Moffett believes that the possible demise of the Affordable Network Connection Program (ACP) also has some responsibility (new registrations stopped in February), even if it is just a one-time event that the US broadband industry has to accept.

Moffett wrote, “The most important thing is that the penetration rate of household broadband has stagnated this quarter and may even decline, especially if the growth of rural households is adjusted based on RDOF (Rural Digital Opportunity Fund) subsidies and unsubsidized marginal subsidies.”

The trend of FWA user growth peaking in various categories is becoming increasingly evident. FWA providers in the United States added 879000 subscriptions in the first quarter of 2024, down from 925000 in the same period last year. AT&T saw a sharp increase in FWA users in the first quarter, but is using its relatively new FWA product, Internet Air, to attract DSL users and enter the market where fiber optic is unavailable. Therefore, AT&T’s use of FWA is far less active than T-Mobile and Verizon.

The growth of fiber optic networks has also slowed down, from 487000 households in the first quarter of 2024 to 517000 households in the same period last year. DSL’s loss in the first quarter was 560000 yuan, similar to the loss of 571000 yuan in the same period last year.

These trends should be good news for American cable TV operators. However, cable TV operators reduced their broadband users by 169000 in the first quarter, far below the growth of approximately 71000 users in the same period last year.

Moffett pointed out, “The main culprit for the weak growth of cable TV broadband networks is the slowing market growth rate, although the decrease in the number of new households and the decrease in ACP access are also one of the reasons.”