T-Mobile Uses Grain’s Spectrum to Meet Low-frequency Requirements

T-Mobile has submitted documents to the Federal Communications Commission in the United States, leasing a low-frequency 600MHz spectrum license from investment management company Grain Management. These licenses are distributed across the United States, and T-Mobile may use them to enhance its 5G signal coverage.

However, T-Mobile only leased a one-year spectrum license. After the end of this year, T-Mobile may renew its lease or sign some kind of agreement with Grain to directly purchase licenses.

The financial terms of the transaction were not disclosed. Companies like T-Mobile and Grain typically do not comment on their spectrum deals.

But T-Mobile’s move on the Grain spectrum is noteworthy as it demonstrates T-Mobile’s continued interest in low-frequency spectrum. Due to its propagation characteristics, this spectrum can typically cover a wide geographic area, but it typically cannot transmit as much data as the mid frequency or high-frequency spectrum.

Due to its 5G radio capabilities, T-Mobile is likely to be able to put Grain’s spectrum into use almost immediately. This is what T-Mobile did during the early stages of the COVID-19 pandemic by signing lease agreements with companies such as Comcast and EchoStar.

Low frequency details

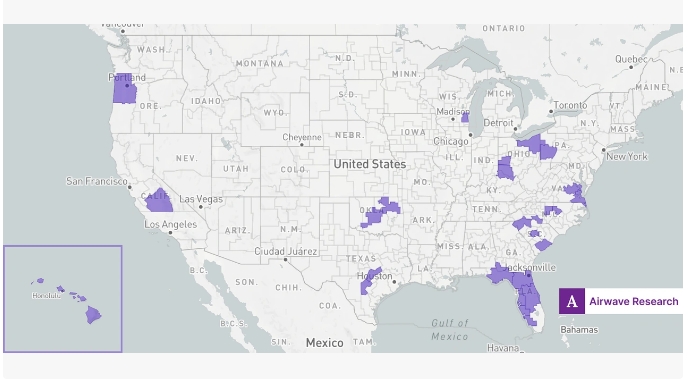

The new leasing agreement between T-Mobile and Grain covers 26 spectrum licenses from Raleigh, North Carolina to Portland, Oregon; Sarasota, Florida; And Austin, Texas. According to Airwave Research, a startup closely tracking US spectrum ownership, the total value of spectrum licenses involved in the transaction is approximately $675.2 million.

Therefore, T-Mobile clearly intends to strengthen its low-frequency assets. For example, T-Mobile agreed to purchase some (or possibly all) of the 600MHz spectrum held by Comcast in 2023. The value of this transaction ranges from $1.2 billion to $3.3 billion, depending on how much spectrum T-Mobile ultimately acquires. It is planned to close in 2028.

Just one year before T-Mobile acquired Comcast Spectrum, T-Mobile agreed to purchase $3.5 billion worth of 600MHz spectrum licenses from another investment company, Columbia Capital.

Mid frequency and high frequency

As T-Mobile gains more low-frequency spectrum, it will either sell or give up some mid frequency and high-frequency spectrum.

For example, the operator agreed to sell all of its 3.45GHz spectrum holdings last year, most of which were sold to Columbia Capital Corporation.

T-Mobile also obtained FCC approval last year to relinquish some millimeter wave spectrum, which the operator said “cannot be effectively deployed… in a way that benefits the public.”

Meanwhile, T-Mobile’s interest in the mid frequency spectrum of the 2.5GHz band has not diminished at all. This spectrum was the core of T-Mobile’s acquisition of Sprint for $26 billion in 2020. Since then, T-Mobile has purchased more 2.5GHz spectrum through auctions and individual transactions.

Grain revenue

As for Grain, many spectrum acquisitions by this investment company may now be yielding returns.

Although Grain and T-Mobile have not disclosed their agreement terms, the value of the 600MHz license has been rapidly increasing. For example, Columbia University sold its 600MHz spectrum to T-Mobile for almost twice the price originally paid in the 2017 FCC auction.

Grain also holds spectrum licenses for the 3.45GHz frequency band, C-band, and other frequency bands.

Grain’s investment in the telecommunications industry goes far beyond the spectrum sector. The company has invested in fiber optic operators including 123NET, Hunter Communications, Ritter Communications, Great Plains Communications, Quintillion, and Summit Broadband, as well as mobile tower operators such as Phoenix Tower International, managed telecom service providers such as Spectrotel, telecom solutions, and logistics providers such as Network Wireless Solutions.