GlobalFoundries Announces $16 Billion Investment in the U.S.

GlobalFoundries, the world’s fifth largest chip foundry, announced on June 4th that it will invest $16 billion in the United States to expand its chip manufacturing and advanced packaging capabilities. This plan has received public support from tech giants such as Apple and SpaceX, as well as strong support from US President Trump.

In a statement, Tim Breen, CEO of GlobalFoundries, said, “We are proud to collaborate with technology leaders to manufacture chips in the United States, driving innovation while enhancing economic and supply chain resilience. The AI revolution is creating strong demand for GlobalFoundries technology, including leading silicon photonics and gallium nitride power devices. The company plans to expand its production capacity in New York State and neighboring Vermont.

Apple CEO Tim Cook publicly supports the plan: “Since 2010, GlobalFoundries has been supplying chips to Apple products. These chips are key components of products such as the iPhone and are a model of American manufacturing leadership. SpaceX Chief Operating Officer Gwynne Shotwell also stated that this investment is crucial for Starlink’s growth.

US Secretary of Commerce Howard Lutnick called this a “model of key semiconductor manufacturing returning to the United States”. The Trump administration has made the return of semiconductor manufacturing a fundamental national policy, and cooperation with GlobalFoundries will ensure the future chip manufacturing capabilities of the United States.

But industry analyst Jeff Koch pointed out that this $16 billion investment has not yet set a specific timeline, and actual execution will depend on market demand. GlobalFoundries usually has an annual capital expenditure of about 2 billion US dollars, and such a large-scale investment requires clearer planning. TechInsights Vice Chairman Dan Hutcheson believes that this is more of a geopolitical and tariff strategy than a simple AI layout.

GlobalFoundries has advantages in the fields of RF, automotive, and low-power specialized devices. Industry insider Handel Jones said that considering that special technology wafers may face tariffs of over 20%, GlobalFoundries’s decision is wise. Silicon photonics and data center power management will become its future growth points.

It is worth noting that apples SpaceX, Customer executives from companies such as Qualcomm, NXP, and General Motors have collectively publicly supported a chip manufacturer’s expansion plan, which is rare. Hutcheson believes that this indicates that these companies are planning to respond to the new economic landscape in the long term and may increase orders for GlobalFoundries.

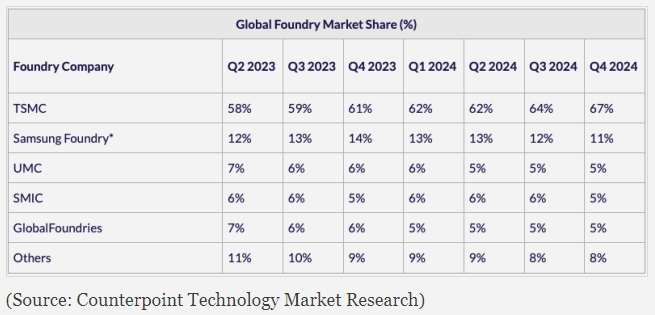

GlobalFoundries’s main AI business is focused on inference applications, and its communication technology connects data centers with the external world, providing key advantages in millimeter wave communication and satellite ground terminal infrastructure. Analysis indicates that Gexin’s successful strategy lies in not directly competing with TSMC in its dominant field.