FWA User Capacity of Three Major U.S. Operators Reached 32 Million

According to New Street Research, major U.S. wireless carriers currently possess network capacity capable of serving up to 32 million fixed wireless access (FWA) users—approximately twice the amount assessed by the company in June 2024.

Considering the spectrum acquired through mergers and acquisitions by carriers, this figure is not surprising. For instance, AT&T purchased EchoStar’s spectrum for $23 billion, T-Mobile acquired USCellular, and Verizon recently bought Starry.

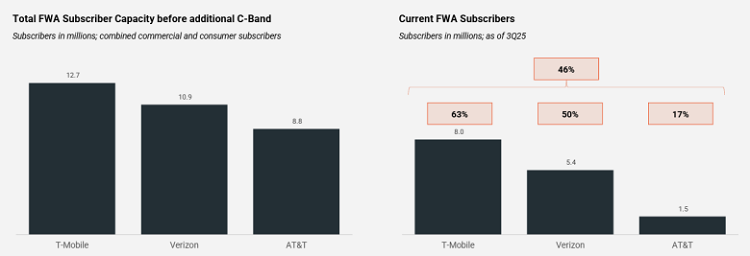

The 32 million capacity includes 20.6 million consumer-grade FWA users and 11.8 million enterprise customers. However, New Street notes that this figure does not account for any additional capacity that may result from future C-band upper segment spectrum auctions. The Federal Communications Commission (FCC) must conduct the auction by July 4, 2027. The company estimates the auction could bring an additional 4 million FWA user capacity for operators, raising the total capacity to approximately 36 million. However, before the auction takes place, operators are already maximizing their existing spectrum.

Capacity Utilization and Targets of Various Operators

For example, analysts at New Street wrote that T-Mobile “is approaching two-thirds of its addressable capacity. We wouldn’t be surprised if new CEO Srini Gopalan announced higher FWA user targets.” The company’s long-term FWA goal is to reach 12 million users by 2028, while also focusing on growth opportunities in urban markets. T-Mobile’s Chief Broadband Officer Allan Samson previously stated that approximately 70% of new FWA customers come from the “top 100 largest cities” in the U.S.

Meanwhile, New Street noted that Verizon aims to achieve 8 to 9 million FWA users by 2028 and has already utilized about half of its capacity. However, among the three major carriers, AT&T has the greatest growth potential in FWA, as it has just begun to ramp up efforts in this area, “currently capturing only about one-sixth of its estimated capacity.”

FWA Equipment Procurement and Market Outlook

In terms of FWA equipment, increased procurement has always been a highlight of the broadband equipment market. A new report from Dell’Oro Group found that although global broadband access equipment revenue decreased by 5% year-on-year to $4.5 billion, operators are still increasing their purchases of FWA customer terminal equipment. Jeff Heynen, Vice President of Dell’Oro Group, said, “Although 5G Sub-6 GHz devices currently dominate, we are seeing an increase in shipments of millimeter wave devices in some markets. ”Verizon has doubled its investment in millimeter wave deployment in the United States, hoping to further increase coverage by leveraging Starry’s coverage area.

Despite frequent activities around spectrum and FWA, New Street expects the net growth of FWA users to gradually decrease starting from 2026. This situation has already occurred at Verizon, with its FWA net increase decreasing from 1.5 million in 2024 to 1.1 million in 2025. However, during the same period, T-Mobile’s net increase in users slightly increased year-on-year from 1.7 million to 1.8 million, while AT&T increased from 500000 to 900000.

New Street analysts wrote, ‘We expect the net user growth of T-Mobile and Verizon to continue to slow from now on, while AT&T’s net growth will remain stable in 2026.’. Overall, we estimate that the net increase in users will slightly slow down in 2026. ”The good news is that the slowdown in FWA growth provides a recovery path for cable broadband operators who have been dealing with FWA competition. New Street predicts that the net growth of wired broadband users will be “only slightly negative” in 2026 and turn positive in 2027.

The prospects of cable TV companies remain bleak

Unfortunately, for cable TV companies, this prediction does not apply. Analysts say, “Although we expect the loss of cable TV users to improve over time, we never believe that the total number of cable TV users will turn into net growth.” They expect that the net growth of cable TV users will not turn positive before 2030.