Ciena Orders Surge by $5 Billion, Facing Challenges in Optical Device Supply

Ciena, an optical network equipment provider, received a large number of cloud orders by the end of 2025, but now it must cope with supply constraints to meet demand in the coming years.

During Thursday’s Q4 2025 earnings conference call, the company’s Chief Financial Officer Marc Graff stated that Ciena is entering 2026 with a backlog of approximately $5 billion in orders. Although the company plans to increase capital expenditures to ensure sufficient production capacity to meet existing and future demands, there is currently a shortage of optical and photonic components in supply. He said, “From what we have seen in the first quarter, we have basically sold out. If we have more supply, we can sell more products.”

Regarding product delivery time, CEO Gary Smith stated that he hopes to shorten the delivery time by the end of next year, but Ciena’s large-scale customers have just begun building their sites. He stated that three ultra large scale clients have chosen Ciena to provide equipment for their “horizontal scaling” training models, with each transaction worth “hundreds of millions of dollars”. Ciena expects to generate revenue from these customers starting in 2026, but Smith points out that the amount of fiber required for data center construction is still extremely large.

“I believe that most of the construction scale will be expanded during 2027 and 2028. These data centers require the laying of massive amounts of fiber optic cables between them, involving huge scale and commitments. From an infrastructure perspective, this will take time,” Smith said. If you are curious about the actual demand for fiber optic in data centers, Dong Hao, the market technology development manager of Corning’s optical communication business, gave an example that Meta’s 1 million GPU data center campus in Louisiana will consume “8 million miles of fiber optic”.

Oversized customers exacerbate fiber and optical supply shortages

Corning is another supplier facing revenue growth while optical supply is tight. Due to its deals with Apple and Microsoft, it is also doubling its investment in manufacturing: producing glass for iPhone and Apple Watch, and manufacturing hollow fiber optics for Microsoft.

Dell’Oro Vice President Jimmy Yu stated that he has not heard too many optical suppliers discuss supply issues, but considering that demand growth is faster than usual, this is indeed a reasonable concern for 2026. He told Fierce that historically, suppliers would ask customers how many products they needed next year, and if the customer’s forecast was insufficient, “then the supply of most projects with long delivery times would be limited.” As for Ciena, the company may have “recognized the higher demand in 2026 early enough and promptly communicated it to its suppliers”.

Preparing for the 800G era

Despite facing supply challenges, Ciena has raised its revenue guidance and currently expects revenue to reach $5.7 billion to $6.1 billion by mid-2026. This is equivalent to a 24% increase in total revenue. Yu said, “I am quite certain that most of the growth will come from the optical network business,” but it may not be entirely from the cloud business. He pointed out that Ciena’s orders from communication service providers increased by 70% this quarter, and they are a “key part” of the optical transmission ecosystem.

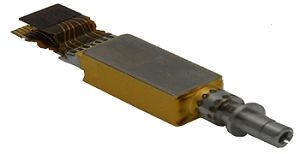

As for Ciena’s newly won super large scale customers, Yu pointed out that this will drive the shipment of a “very large number” of 800 ZR+optical pluggable devices starting from 2026. In fact, Ciena executives have stated that they have already shipped 800G ZR optical modules to three other cloud providers for testing and certification, and the company plans to increase production in the first half of next year.

Ciena is not the only company vigorously promoting 800G equipment. AOI is expanding its manufacturing scale for 800G data center transceivers and announced this week that an unnamed hyperscale customer (likely AWS) has secured its first bulk order.