Ciena Company Not Currently Concerned about Tariff Issues

According to Fierce Network, Ciena is currently not concerned about tariff issues, but is closely monitoring relevant developments. In the current market environment, many companies are concerned about the potential impact of tariffs, but Ciena does not seem to be among them.

Ciena’s Chief Financial Officer stated during the recent earnings conference call that the company has not yet included tariff factors in its financial expectations. This stance is based on the company’s assessment of the current market conditions and confidence in its own business model.

Ciena is one of the world’s leading optical suppliers, with a focus on high-speed connectivity. The company provides network systems, services, and software, committed to building the most adaptable network to meet the growing digital needs of customers.

However, Ciena is also aware of the potential risks that tariff issues may bring. The company stated that if tariff policies change, it may have a certain impact on the supply chain. But currently, Ciena is more focused on how to continue driving technological innovation and business growth.

In its recent financial report, Ciena announced its performance for the first quarter of fiscal year 2025. The report shows that the company’s revenue was 1.072 billion US dollars, a year-on-year increase of 3.3%. This growth is mainly due to the increase in revenue from service providers and the growth in revenue from non telecom customers.

Ciena also revealed that it has seen a sustained growth trend in the demand for artificial intelligence (AI) related networks. No matter how the tariff issue develops, the demand for bandwidth related to AI is expected to continue to grow during this period.

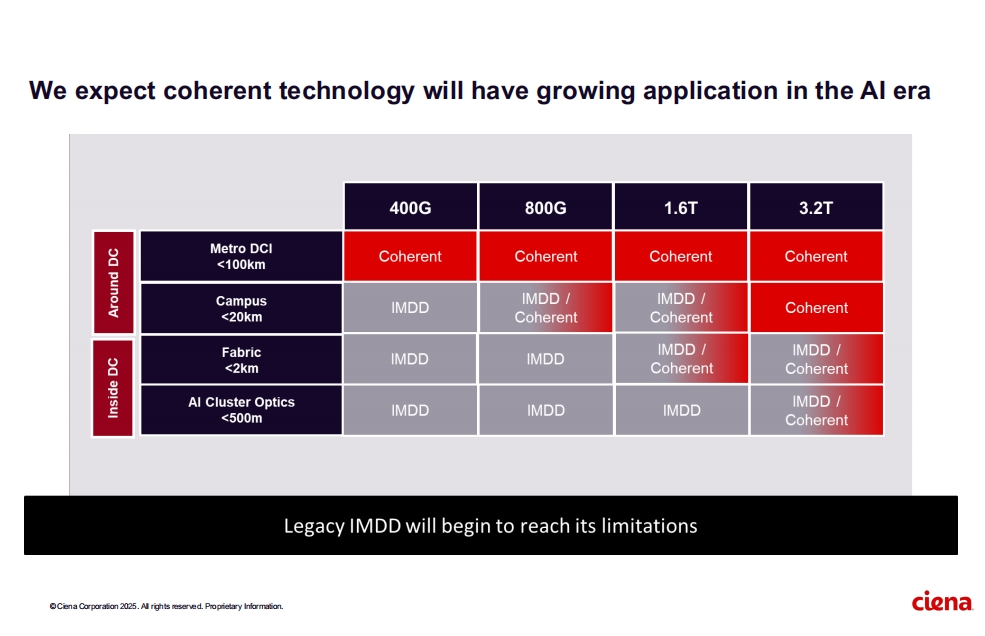

In addition, Ciena emphasized its leading position in the field of optical technology. The company expects that related technologies will have a wider range of applications in the AI era and is meeting market demand through innovative products.

In terms of finance, Ciena’s adjusted gross profit margin for the first quarter of fiscal year 2025 is 44.7%, with adjusted operating expenses of $347.4 million. The company also announced a stock repurchase plan to enhance shareholder value.

Overall, Ciena has maintained a steady development trend in the current market environment and is confident in future growth opportunities. The company will continue to monitor market trends and adjust its strategy as needed.