Corning Enterprise Network Business Surges 81%

In July 2025, Corning announced its financial performance for the second quarter of 2025 and provided a third quarter outlook. The company performed exceptionally well in the quarter, with core sales reaching 4.05 billion US dollars, a year-on-year increase of 12%; Core earnings per share of $0.60, an increase of up to 28%.

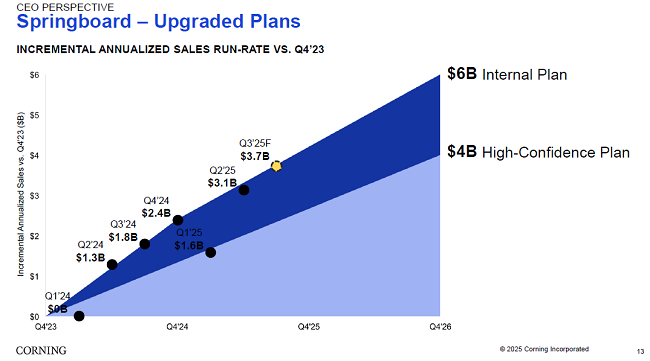

Wendell P. Weeks, Chairman and CEO of Corning Inc., stated, “We have delivered an outstanding Q2 performance report. Overall, key long-term trends and our ‘More Corning’ content strategy have driven demand for our products, and we continue to seize the strong profit growth opportunities planned in the upgraded Springboard program. “

Optical communication business

In terms of optical communication business, the company has performed particularly outstandingly. Enterprise network sales increased by 81% year-on-year, mainly due to the sustained strong demand for new generation artificial intelligence products (mainly scale out demand). In addition, the data center interconnection products that the company started shipping in the first quarter achieved a month on month doubling of sales in the second quarter. Currently, three industry-leading clients have adopted this new technology, and it is expected that the business will grow rapidly, reaching a market size of $1 billion by the end of this decade.

Weeks pointed out, “Looking ahead, we expect the strong performance of the Springboard program to continue. We have seen a very positive response from customers towards our new generation of artificial intelligence products and American made solar products. We will also add more Corning product content in mobile consumer electronics, displays, automotive, and optical communication platforms. “

Chief Financial Officer Ed Schlesinger said, “Our excellent second quarter performance exceeded expectations, once again demonstrating our ability to significantly increase returns while executing the Springboard plan. On a year-on-year basis, core sales increased by 12%, core operating profit margin expanded by 160 basis points to 19%, core earnings per share increased by 28%, and core investment return rate increased by 210 basis points to 13.1%. In addition, the adjusted free cash flow increased by 28% year-on-year, reaching $451 million.”

Financial data

In terms of financial data, GAAP sales for the second quarter were $3.86 billion, with core sales of $4.05 billion; GAAP earnings per share are $0.54, and core earnings per share are $0.60. The GAAP gross profit margin was 36.0%, and the core gross profit margin was 38.4%, an improvement of 680 basis points and 50 basis points respectively compared to the same period last year. GAAP operating cash flow was $708 million, and adjusted free cash flow was $451 million, both achieving year-on-year growth.

For the third quarter, the management expects to continue maintaining the strong performance of the Springboard plan, achieving double-digit year-on-year sales and profit growth. The company expects core sales to reach $4.2 billion, with core earnings per share ranging from $0.63 to $0.67. This guideline takes into account two factors: firstly, the current implementation of tariffs has an impact of approximately 0.01 to 0.02 US dollars; The second is a temporary cost increase of approximately $0.02 to $0.03 due to increased production to meet the growing demand for new generation artificial intelligence and American made solar products.

Business restructuring

In terms of business restructuring, starting from January 1, 2025, the company will merge its automotive glass solutions business and environmental technology business into a new automotive division. The relevant comparative data has been adjusted to comply with the new departmental reporting structure.

Weeks concluded, ‘We are in the middle stage of the Springboard program and the return situation has significantly improved.’. The strong growth momentum has enhanced our confidence in maintaining our development momentum in 2026 and beyond. The company specifically points out that as ultra large scale enterprises create more functional nodes and equip each node with more GPUs, the “scale up” opportunity will be 2-3 times the scale of the existing $2 billion enterprise network business.

Schlesinger added, “Since the launch of the Springboard program, we have achieved significant growth in sales, with earnings per share growing at more than twice the rate of sales and generating strong adjusted free cash flow, significantly improving our return situation. “

In the field of optical communication, in addition to outstanding performance in enterprise network business, operator customers also plan to expand fiber optic networks in the future. The company stated that it has achieved strong incremental profits on additional production, demonstrating a good operational leverage effect.