LC: Open RAN/vRAN Market Suspending Restructuring

Recently, LightCounting (LC) and Terminal Research released the 1H23 Open and Virtual Radio Access Network Report 1H23 Update.

As expected, the 1H23 research results confirm that the Open RAN/vRAN market is slowing down and will tend to stabilize by 2025 without a “relay” switch between early adopters (Lotte Mobile, NTT Docomo, and DISH, respectively) and the next batch of adopters. At the same time, the ecosystem continues to expand, and government funds continue to flow globally to promote the development and adoption of new architectures.

In 2021, Japan became the first country in the world to adopt Open RAN and Open vRAN, continuing to prove skeptics wrong and forcing critics to tighten their spending: NTT docomo and KDDI dominated brownfield deployment, while Lotte Mobile led Greenfield deployment, which in turn put Fujitsu and NEC among the leaders. The 1H23 survey results show that:

-Fujitsu, NEC, Rakuten Symphony, and Samsung hold the top four positions in the total market share of Open vRAN.

-NEC, Fujitsu, and Samsung are the top three RU suppliers.

-Fujitsu, Rakuten Symphony, and Mavenir are the top three CU/DU suppliers.

Without the Telecommunications Infrastructure Project (TIP) launched in 2016, the O-RAN Alliance launched in 2018, and the tireless efforts of US leaders in 2018-2020 to persuade dozens of countries, including their allies, to prohibit Chinese suppliers from participating in their 5G deployment, this would not have been possible.

Teral Stephane, founder and chief analyst of LightCounting Market RESEARCH, stated: The Open RAN/vRAN market is unstoppable, rising, and preparing to dominate the world and destroy RAN’s world. We expect the world to transition to Open vRAN by 2024-2025, driven by large first tier CSPs around the world. Therefore, patience is needed because at this point, every player is involved. However, Economics 101 shows that not every player in the ecosystem can succeed.”

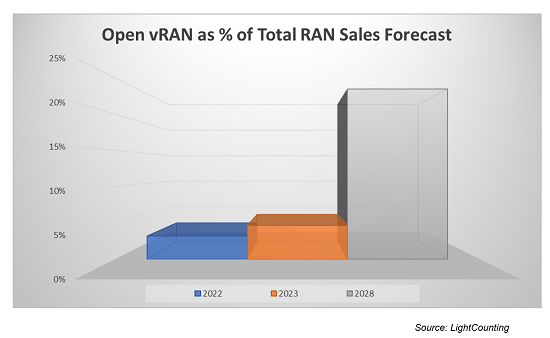

Therefore, due to some doubts in the industry, the Open vRAN market will experience a short-term (2023-2024) pause. LC’s forecast for 2023 has been revised downwards, but still shows growth. The good news is that there is increasing consensus around the world that Open vRAN will become the main architectural component of mobile networks in the second half of this decade. Therefore, the compound annual growth rate of this market from 2022 to 2028 is 33%, and by 2028, Open vRAN will account for over 20% of global RAN sales.

Finally, LC analysis suggests that Open RAN is a strong competitor for indoor use cases, especially as Open vRAN can serve as a substitute for DAS as it provides the same benefits as DAS, but with greater flexibility and cost-effectiveness. Under the leadership of JMA Wireless, the penetration of Open vRAN in the indoor DAS field will also spread to the enterprise dedicated wireless network field currently dominated by traditional RANs.