Mobile Experts: 6G Scale may Be Halved, Software Revenue will Surge

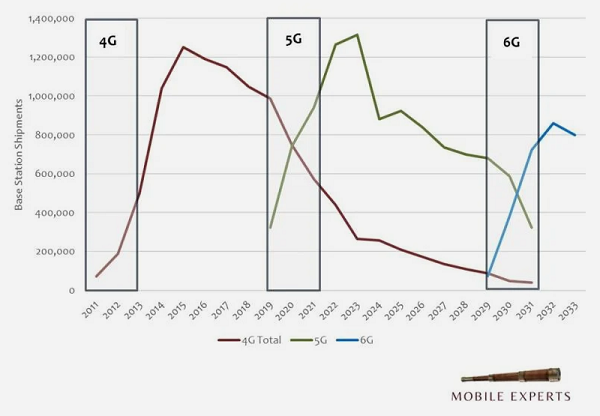

Mobile Experts released its flagship forecast report last week, estimating the deployment range of 6G during the 2030-2033 period through in-depth research. In short, we expect the number of base stations to be approximately half of the 4G and 5G cycles. Please allow me to explain the reason.

We have developed a complex traffic growth model that covers various applications ranging from voice and video streaming to AI driven traffic, AR/VR traffic, video chat, and IoT traffic. Some of the results were surprising, and we also pointed out some significant errors in similar modeling done by Ericsson in the past year. Especially, we believe that operators should pay attention to the uplink traffic related to AI, and some non AI applications will also drive significant traffic.

It should be clarified that our estimation of the scale of 6G construction is based on our traffic growth model. The model is subdivided by regions of the world, by applications, by up and down links, and by multi-level population density (dense urban areas, urban areas, suburbs, and rural areas).

In addition to modeling new sources of data demand, we also calculated the increase in network capacity. The use of AI for wireless access network optimization will significantly increase the capacity of typical 5G networks. The new spectrum will enter the market. The upgrade of Massive MIMO and Gigabit MIMO will increase capacity. Satellites may actually play a role in capacity models, not just for coverage. We have considered all these factors. Ultimately, we do believe that more capacity will be added in specific urban markets. Delay requirements and other factors can be seen in the details of the model.

Reviewing the construction wave of 4G and 5G

During the 4G cycle, RAN suppliers sold over one million base stations annually for four consecutive years. During the 5G wave, the peak heights were roughly the same, but the duration was shorter. The most important reason is that 5G has not introduced any new applications that require nationwide coverage, so many network operators only deploy 5G in cities and keep LTE unchanged in rural areas. The same situation will occur with 6G, at least until new applications create enough value to justify the upgrade.

The changing trend of RAN revenue structure

But that’s not all. We see a decrease in hardware shipments entering the RAN market, but revenue related to software upgrades will increase sharply. Our RAN revenue forecast predicts that due to AI/ML software upgrades, the rise of vRAN, and Open RAN applications, the compound annual growth rate of RAN network software will reach 28%.

In the 4G and 5G cycle, I had almost 200 customers who mainly wanted to obtain information to understand the days of ‘how much do we need to build?’ have come to an end.

The mobile market is entering the stage of commodification, and investment in new infrastructure will become limited. More attention will be focused on optimizing existing infrastructure. Telecom operators will undergo refined adjustments, so all of us need to understand the specific details of how they will improve efficiency.

Joe Madden is the Chief Analyst at Mobile Experts. Mobile Experts is a network composed of market and technology experts specializing in analyzing the wireless market. Disclaimer: Nokia is a customer of Mobile Experts.