Yole: Disconnect between Semiconductor Supply and Demand in Growth Cycle of Generative AI

Present Situation

-Due to limited supply, the price of Nvidia GPUs remains at a very high level. This will bring higher revenue to their server semiconductors, but overall sales will decrease. Also, it will inevitably reduce the growth of wafer demand for advanced nodes.

-As competition intensifies in the field of artificial intelligence semiconductors, the price of Nvidia GPUs may eventually decrease. This will mark a shift in the market towards a demand driven model. What’s more, it will bring more wafer production growth to overall semiconductor production.

Why is this important? The report from Semicon Taiwan 2024 reveals some interesting perspectives on the semiconductor industry. These insights are derived from Yole Group’s semiconductor series reports, particularly their latest ‘2024 Semiconductor Manufacturing Industry Overview’ report.

Latest Developments in Semiconductor Industry

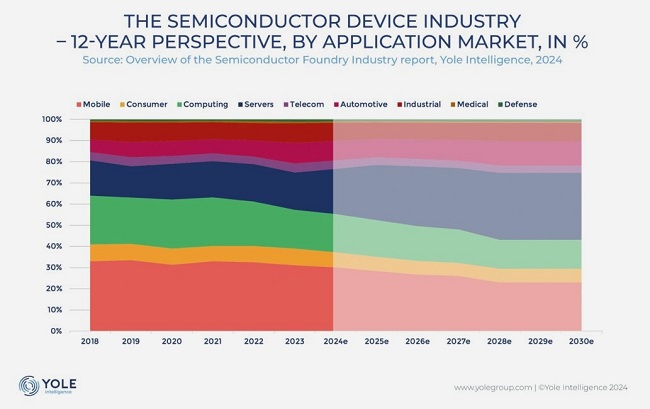

Various parts of the world are competing to increase semiconductor production capacity, with an expected increase from 10500 thousand 12 inch equivalent wafers per month (10500 kWpm 12 ” eq.) to 13500 thousand 12 inch equivalent wafers per month (13500 kWpm 12 ” eq.) by 2029, with a five-year compound annual growth rate (CAGR) of 4.8%. Such a scale of growth and its associated costs is not uncommon for an industry accustomed to spending over 20% of its revenue on capital expenditures. Driven by the growth of production capacity, the revenue scale of this market will reach $1 trillion by 2030.

Therefore, this has had serious consequences for competitors, especially Intel. Because it is losing its semiconductor crown that it has maintained for about 30 years. In 2024, revenue from semiconductor devices may increase by over 25% year-on-year. And it reaches approximately $630 billion, but not all players will benefit from it.

For foundries like TSMC, it will also have a significant impact. Revenue will increase. However, it will not be linked to high-yield wafer production related to generative AI. Because there will not be any such production in the short term. When Nvidia maintains high prices, wafer production may remain at a lower level. If this situation occurs, it means that competition has not emerged. And it marks a huge paradigm shift from the previous era of mass production, when Apple was competing against Intel, Nokia against BlackBerry, or more recently, Apple against Samsung against Huawei. These competitions have pushed the semiconductor industry to its current state.

Despite the lack of competition among top competitors, the semiconductor industry may experience a major growth cycle in 2025 and 2026. The special feature is that devices, subsystems, and materials are also likely to enjoy this large growth cycle. Any reasonable analysis would point to maximizing capital expenditures at the bottom of the cycle, that is, last year for the memory and logic fields under Moore’s Law, and this year for the power and simulation, as well as optoelectronic and sensor fields beyond Moore’s Law. However, this time the situation is not like that. Maybe the capital expenditure of factories will increase in the next two years. Based on this scenario, we must issue some warning signals as the results of some of these investments may be disappointing.

Before that, let’s enjoy this growth cycle driven by the new generation of AI with a clear understanding of the disconnect between the demand driven semiconductor market and the expected supply of semiconductor foundry capacity. We can never fully predict the future, and here, Yole Group will ensure that you understand the state of the semiconductor industry.